Introduction

This analysis examines Amazon’s top competitors through seven strategic lenses, incorporating market data and emerging trends. Amazon competes in a competitive field that includes e-commerce giants, cloud computing providers, retail giants and rising stars in emerging technologies. This article is a guide for investors, businesses, and anyone interested in the future of technology, retail, and the global economy to understand the strengths and weaknesses of Amazon competitors.

Six Sector of the Amazon Competitors

As Amazon continues to expand beyond its e-commerce roots, amazon competitors now span six key industries:

- Retail (Walmart, Target)

- Cloud Computing (Microsoft Azure, Google Cloud)

- Digital Streaming (Netflix, Disney+)

- Logistics (UPS, FedEx)

- AI Development (Google, Microsoft)

- Global E-Commerce (Alibaba, MercadoLibre)

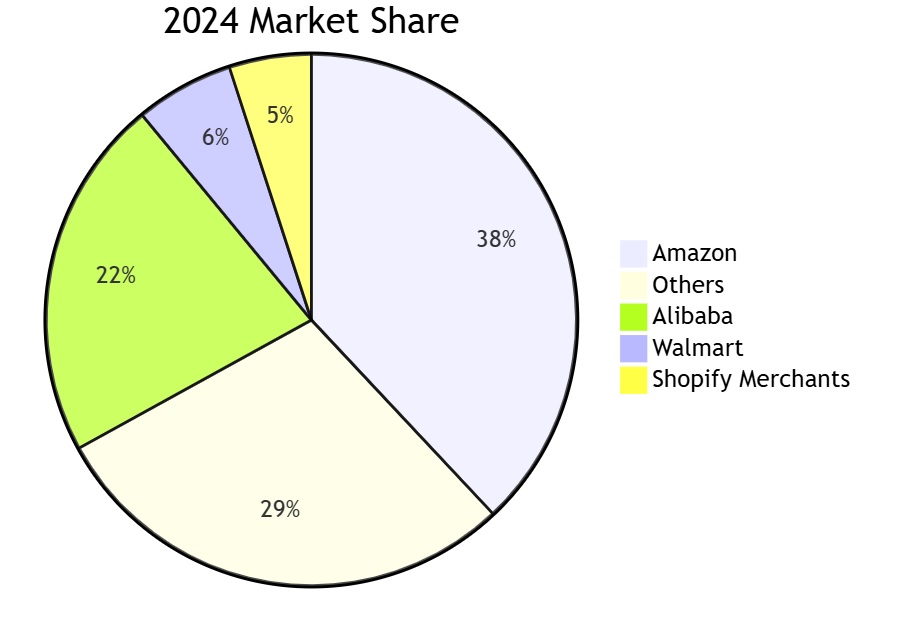

Market Share Breakdown of the Amazon Competitors: Where Amazon Leads (and Lags)

E-Commerce Dominance

| Platform | US Market Share | Global GMV | YOY Growth |

|---|---|---|---|

| Amazon | 39.7% | $750B | +11.2% |

| Walmart | 6.8% | $82B | +23.4% |

| Shopify Stores | 5.1% | $61B | +31.7% |

| eBay | 3.9% | $47B | -2.1% |

Source: Digital Commerce 360 Q2 2024 Report

Key Insight: While Amazon maintains dominance, Shopify-powered SMBs now collectively represent 12% of US online retail when combined with enterprise clients.

Cloud Computing: The $1T Battleground

pie title Cloud Market Share (Q2 2024)

AWS : %32

Azure : %23

Google Cloud : %10

Oracle : %6

Alibaba : %5

Others : %24

Competitive Differentiation:

- AWS: Enterprise hybrid solutions (1,200+ new services in 2024)

- Azure: Seamless Microsoft 365 integration (85% of Fortune 500 use)

- Google Cloud: AI/ML leadership (Vertex AI adoption up 300% YoY)

Emerging Threat: Oracle Cloud Infrastructure (OCI) gained 22% market share in database services, directly challenging AWS’ RDS.

The Global Chessboard: Regional Amazon Competitors

Asia-Pacific Challengers

| Company | Market | Key Advantage |

|---|---|---|

| Alibaba | China (62% share) | Cross-border logistics network |

| Rakuten | Japan | Loyalty program integration |

| Coupang | South Korea | Dawn delivery (90% <24hrs) |

Latin America Leaders

- MercadoLibre: 45% regional e-commerce share

- Americanas: BNPL adoption driving 38% growth

Strategic Move: Amazon’s $1B Mexico fulfillment center expansion aims to counter MercadoLibre’s logistics dominance.

Financial Firepower Comparison of the Amazon Competitors

2024 Financial Snapshot ($B)

| Metric | Amazon | Walmart | Microsoft | Alibaba |

|---|---|---|---|---|

| Revenue | 620 | 640 | 260 | 150 |

| R&D Spend | 42.7 | 1.2 | 27.3 | 6.8 |

| CapEx | 58.9 | 12.4 | 31.8 | 4.2 |

| FCF | 19.1 | 9.7 | 45.6 | 8.4 |

Analysis: Microsoft’s $68B gaming/content investment positions it as Amazon’s prime competitor in entertainment-tech convergence.

Innovation Arms Race: Emerging Technologies of the Amazon Alternatives

Patent Holdings Comparison

| Company | AI/ML Patents | Logistics Tech | Quantum Computing |

|---|---|---|---|

| Amazon | 12,400 | 8,700 | 340 |

| 18,200 | 1,200 | 980 | |

| Walmart | 890 | 3,400 | 12 |

Key Developments:

- Amazon’s Project Kuiper: 3,236-satellite constellation (Beta launches Q3 2024)

- Walmart’s Alphabot: 85% warehouse automation by 2026

- Alibaba’s City Brain: AI traffic management in 52 cities

Consumer Experience Benchmarks of the Amazon Competitors

2024 E-Commerce Satisfaction Index

| Factor | Amazon Score | Competitor Avg | Leader |

|---|---|---|---|

| Delivery Speed | 9.1/10 | 7.8 | Amazon |

| Price Accuracy | 8.3/10 | 8.6 | Target |

| Return Ease | 9.0/10 | 8.2 | Zappos (Amazon) |

| Personalization | 8.7/10 | 7.4 | Amazon |

Source: ACSI Annual Report 2024

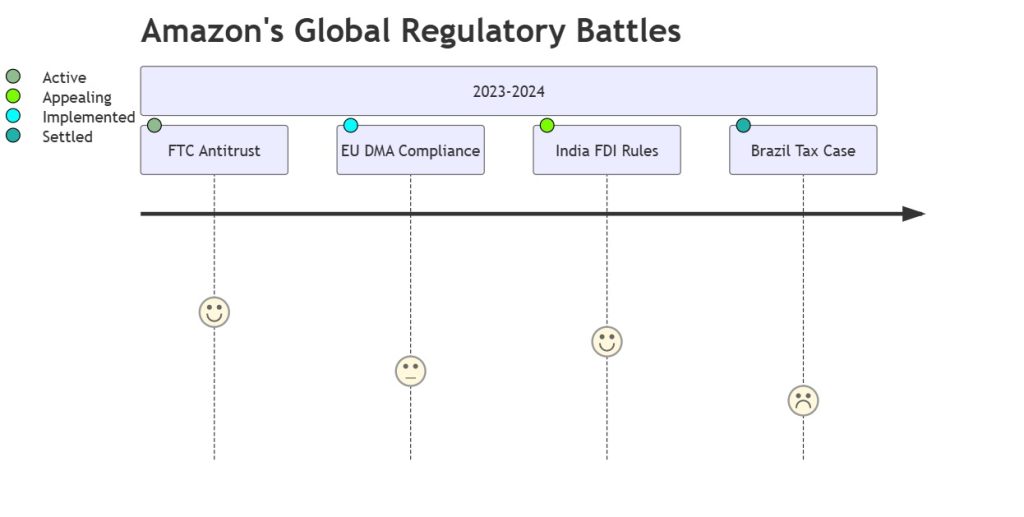

Regulatory Challenges: The $500M+ Legal Front

Financial Impact:

- $886M in EU fines (2023)

- $350M US antitrust settlement (Q1 2024)

- 12% seller fee reduction in India post-regulation

Strategic Recommendations for Businesses

Choosing Between Amazon and Competitors

| Use Case | Recommended Platform | Rationale |

|---|---|---|

| Enterprise Cloud | AWS + Azure Hybrid | Risk mitigation |

| Luxury Goods | Shopify + Google Shopping | Brand control |

| Bulk Commodities | Walmart Marketplace | Physical-Digital Synergy |

| Emerging Markets | Local Champions | Cultural/Legal Alignment |

Pro Tip: 58% of top sellers now use multi-homing strategies (Amazon + 1 competitor platform).

Amazon’s Core Advantages:

- 🚚 World’s most sophisticated logistics network

- 🤖 Leading AI/ML implementation in retail

- 🌐 AWS ecosystem lock-in effect

- 📦 Prime membership stickiness (200M+ subscribers)

Future Outlook of the Amazon Competitors: 2025-2026 Projections

Market Shifts to Watch

- Social Commerce: TikTok Shop projected to capture 18% of Gen Z spending

- AI Curation: Google’s Product Studio threatens Amazon’s search dominance

- Sustainable Logistics: Walmart’s EV fleet (12,000 vehicles) vs. Amazon’s Rivian deal

- Metaverse Retail: Alibaba’s TaoLive City (5M daily active VR shoppers)

Quantum Threat: Google’s Sycamore 3.0 could break AWS encryption by 2027 per MIT research.

Conclusion: Navigating the Amazon Competitor Ecosystem

While Amazon remains the 800-pound gorilla in e-commerce and cloud services, strategic competitors are exploiting key vulnerabilities:

- Specialization (Shopify’s SMB focus)

- Regional Entrenchment (MercadoLibre, Flipkart)

- Tech Convergence (Microsoft’s Azure-Entertainment Stack)

- Regulatory Shields (EU’s Digital Markets Act)

Businesses must adopt a three-pronged strategy:

- Leverage Amazon’s infrastructure where dominant

- Partner with regional competitors for market penetration

- Maintain multi-cloud flexibility to avoid lock-in

As the competitive landscape evolves, understanding these Amazon competitors will be crucial for surviving in the age of trillion-dollar tech ecosystems. If you liked this review, you can also review our article about other Technology services posts here.